-

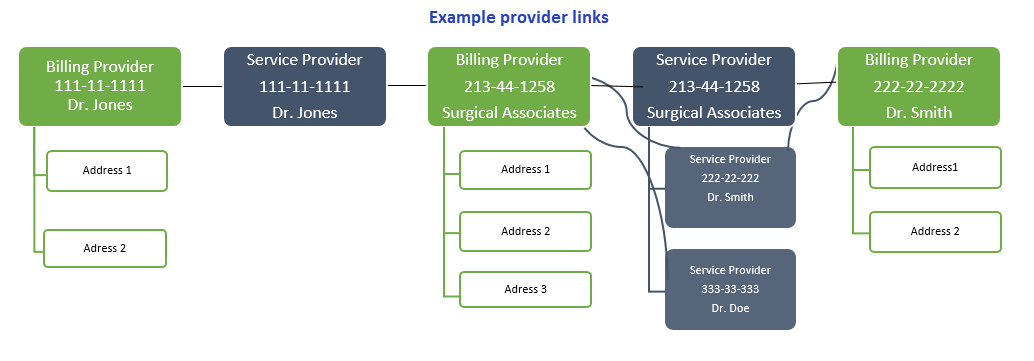

Every billing provider must have a service provider.

Example, Dr. Jones bills the fund office for work that he performed.

-

One billing provider can have multiple service providers.

Example, Surgical Associates bills the fund office for each of the doctors within its organization (Dr. Jones, Dr. Smith, etc.).

-

One service provider can be linked to multiple billing providers.

Example, Dr. Smith is a service provider with Surgical Associates and is a service provider under his own number.

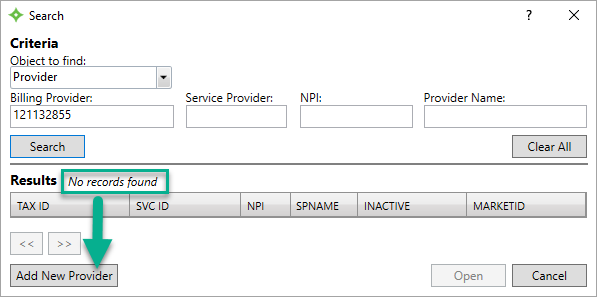

If a claim was entered or received electronically with a provider that isn't in the system, you’ll need to add a new provider. Without a provider record for a claim, the claim will pend. After you add a billing provider, you’ll need to add any service providers.

Access the billing provider demographics tab

- Search to ensure the billing provider doesn't already exist in the system. Use the

Provider->by Billing Provideroption from the search. -

If the billing provider doesn’t exist, the resulting window displays with No records found.

-

Click

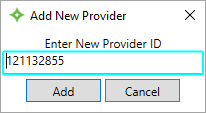

Add New Provider. A dialog displays with the provider number you searched for.

-

Click

Addto begin creating a provider record for the new provider.

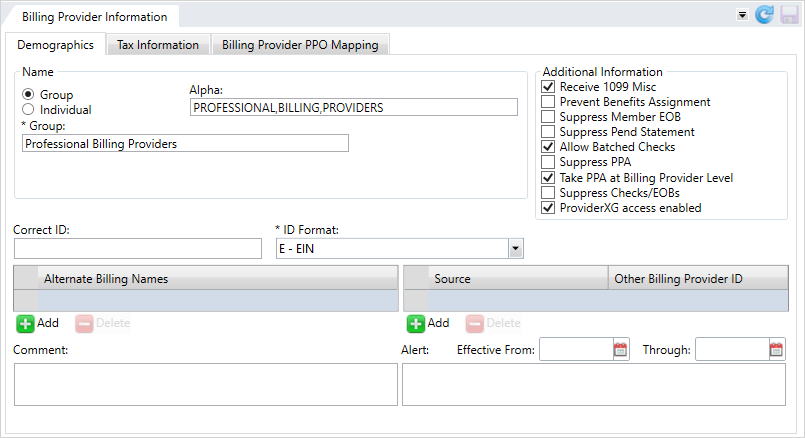

Billing provider field descriptions

Billing provider field descriptions

* indicates a required field

Name Group/Individual Select either

GrouporIndividualto indicate the provider type.Alpha Auto-updated, read-only field based on the group or individual information entered, used to sort the provider's name in reference lists.

Group The provider group's name. Individual

When the provider isn't in a group these fields apply.

Last Name*—The individual's last name.First Name—The individual's first name.Middle Name—The individual's middle name. You can enter a middle initial rather than a full name.Prefix—A title that displays at the beginning of a person's name to indicate marital status and gender, education, or occupation, (e.g., Dr., Mrs., PhD, etc.)Generation—Suffix to distinguish persons that share the same name in a family, (e.g. Jr., II, Sr, etc.)Select a generation from the list. The list only displays if the System Administrator Control (SAC) is set to perform a data validation on the Generation field.Title—A professional or some other designation that comes at the end of a name, for example, CPA, MD, ESQ, etc. Select a title from the list. The list only displays if the System Administrator Control (SAC) is set to perform a data validation on the Title field.

Additional Information Receive 1099 Misc

Indicates the 1099-MISC form will be sent to the billing provider when it's issued. Prevent Benefits Assignment

Prevent operators from assigning services and benefits to the billing provider. Suppress Member EOB

Prevent generating member EOBs  EOBs are sent to members and payees to inform them of the disposition of claims. Typically an EOB identifies the date and type of service, the billed amount, deductibles, co-insurance, and an explanation of any ineligible charges. An EOB can also be a helpful tool in identifying fraudulent claims, as the member receives notification even when payment is made to the provider. An EOB isn't a bill. when the billing provider is paid.

EOBs are sent to members and payees to inform them of the disposition of claims. Typically an EOB identifies the date and type of service, the billed amount, deductibles, co-insurance, and an explanation of any ineligible charges. An EOB can also be a helpful tool in identifying fraudulent claims, as the member receives notification even when payment is made to the provider. An EOB isn't a bill. when the billing provider is paid.Suppress Pend Statement

Prevent a pend statement being generated for the billing provider. Allow Batched Checks

Indicates that batch multiple claims payable to the billing provider are on one check. Suppress PPA Indicates that the PPA window won't display in claims entry or claims processing when the associated service provider is on the claim.

- Your system might be configured to display suppress the PPA window if the claim is zero.

This field won’t display for the first service provider associated with this billing provider.

If an operator isn't allowed to take PPA (security settings), the PPA window will be suppressed. If the provider or member has a PPA, pend code P28 will be applied to the claim so that an operator who has the ability to determine whether to take PPA or not can complete the claim.

Note: Contact your basys representative to set or change SAC (System Administration Control) settings. Don't change SACs without first consulting basys as changing them can affect other functions and global system settings.Take PPA at Billing Provider Level - If your system is configured to take prior payment adjustments at the service provider level, but this billing provider does not, use this option to have any prior payment adjustments taken at the billing level for any associated service providers.

- If this option isn’t selected and your system is configured to take the prior payment adjustments at the service provider level, the PPA will apply to the service provider and not the billing provider.

Note: Contact your basys representative to set or change SAC (System Administration Control) settings. Don't change SACs without first consulting basys as changing them can affect other functions and global system settings.Suppress Checks/EOBs Indicates that checks and EOBs are suppressed for the billing provider. ProviderXG access enabled Enables user access to the ProviderXG portal. You must select this check box to let Provider contacts access ProviderXG (see Add, update, or delete a provider contact).

Note: If you restrict access to ProviderXG and then enable access again, the contacts previously set up to use the portal on the billing provider's Contacts screen keep their account credentials.Correct ID

The ID to use for this billing provider. A billing provider with this ID must already be in the system.

- Use when bills were originally submitted under this provider ID and were later determined to be incorrect.

ID Format*

The provider ID format.

E—EIN.S—SSN.

Alternate Billing Names

Names other than the billing provider or service provider associated with this billing provider.

Source/Other Billing Provider ID

Other billing provider identifiers along with the source of the ID.

Source—The data source for the other ID.Other Billing Provider ID*—The ID.

Comment

Additional information associated with the provider. Include information that will help other users quickly respond to inquiries about the billing provider. The comment can be up to 50 characters long.

Effective From

Effective Through

Start and end dates for provider alert messages. Click  and select a date or enter a date in

and select a date or enter a date in MM/DD/YYYYformat.Alerts with effective dates only show on a claim when they are within the effective date range.

Alert

Important or critical information about the provider. The alert can be up to 150 characters long.

- The Claims or provider demographics data tile will show an alert icon

next to the billing provider's name.

next to the billing provider's name. - The alert shows in the Provider Alerts window (if your office is configured that way) and in the Alerts tab when processing a claim associated with the provider. You can add an effective date range to limit the alerts.

- Billing Provider Information defaults to

Groupand notIndividual. If the billing provider is an individual choose theIndividualoption to display additional fields.

Add a billing provider

A billing provider can be either a group of service providers or one service provider that is the same as the billing provider. The billing provider will receive payments for services provided by its service providers. The billing provider record is the basis for maintaining service providers as well as the means of issuing 1099's at the end of the year. It’s imperative that this information be carefully updated.

As billing providers are added, they are automatically created as service providers of themselves.

Before additional service providers are added, determine whether these providers will be added based on an actual individual ID number or based on system created incremental numbers.

- Using a provider's actual ID# will improve your ability to identify service providers and reference data.

- Service providers can be added through Add/Update Provider or during Claim Entry. Decide which method is best for your site and develop a process and train the appropriate individuals.

- Be sure they are clear on PPO and Discount arrangements and how they are maintained on the service provider level. Also remember to set up the provider as a PCP

A physician who serves as a group member's primary contact within the health plan. In a managed care plan, the primary care physician provides basic medical services, coordinates and, if required by the plan, authorizes referrals to specialists and hospitals. if you're using Point of Service

A physician who serves as a group member's primary contact within the health plan. In a managed care plan, the primary care physician provides basic medical services, coordinates and, if required by the plan, authorizes referrals to specialists and hospitals. if you're using Point of Service A Point of Service (POS) plan is an "HMO/PPO" hybrid; sometimes referred to as an "open-ended" HMO when offered by an HMO. POS plans resemble HMOs for in-network services. Services received outside of the network are usually reimbursed in a manner similar to conventional indemnity plans (e.g., provider reimbursement based on a fee schedule or usual, customary and reasonable charges)./referral tracking

A Point of Service (POS) plan is an "HMO/PPO" hybrid; sometimes referred to as an "open-ended" HMO when offered by an HMO. POS plans resemble HMOs for in-network services. Services received outside of the network are usually reimbursed in a manner similar to conventional indemnity plans (e.g., provider reimbursement based on a fee schedule or usual, customary and reasonable charges)./referral tracking Tracking process that allows administrators to manage health care costs with a Primary Care Physician is the "gatekeeper" for participants' health care needs..

Tracking process that allows administrators to manage health care costs with a Primary Care Physician is the "gatekeeper" for participants' health care needs..

- Be sure they are clear on PPO and Discount arrangements and how they are maintained on the service provider level. Also remember to set up the provider as a PCP

- Enter the required fields on the

Demographicstab and any optional information. - Click the

Tax Informationtab and enter information. See Update W-9 information. -

Click

to save.

to save.- If the information has errors, the tabs containing the errors are highlighted in red. The Invalid Data Table icon also displays to all you to view all of the errors.

- The

Addressestab displays to enter the provider's address. See Add or update a provider's address.

Add a service provider

After you have added a Billing Provider, you can add a service provider to the billing provider's account.

- From the Billing Provider session, click the

Provideroption in the left navigation pane and chooseAdd Service Provider. A Service Provider tab opens. -

Enter the required field values on the Demographics tab:

Last Name and Provider ID.To have the system assign an ID to the Service Provider, select

to the right of the Provider ID.Hint: Using a provider's actual ID# will improve your ability to identify service providers and reference data.

to the right of the Provider ID.Hint: Using a provider's actual ID# will improve your ability to identify service providers and reference data. - Enter any necessary information into the Additional Information and Additional Matching Criteria tabs. See Provider discount, incentive plan, or other service information.

-

Click

to save.

to save.- If the information has errors, the tabs containing the errors are highlighted in red.

- Point to

to view the errors.

to view the errors.

Handling liens against a provider

For cases when a provider has a lien against them from the IRS, the following steps should be taken to provider proper payment.

- Set up an alternate billing name of the "IRS" and add a separate address for the IRS under the billing provider with the lien.

- Audit or hold all claims for this provider until the thru date stated on the levy or lein notice.

- Cut one check payable to the IRS and hand type on the check the information required by the IRS. This information will be specified in the levy letter.

- Send EOB

EOBs are sent to members and payees to inform them of the disposition of claims. Typically an EOB identifies the date and type of service, the billed amount, deductibles, co-insurance, and an explanation of any ineligible charges. An EOB can also be a helpful tool in identifying fraudulent claims, as the member receives notification even when payment is made to the provider. An EOB isn't a bill.s as they would normally be sent.

EOBs are sent to members and payees to inform them of the disposition of claims. Typically an EOB identifies the date and type of service, the billed amount, deductibles, co-insurance, and an explanation of any ineligible charges. An EOB can also be a helpful tool in identifying fraudulent claims, as the member receives notification even when payment is made to the provider. An EOB isn't a bill.s as they would normally be sent. - Remove the audit after the check has been sent. The alternate name should also be removed and the IRS's address inactivated.